|

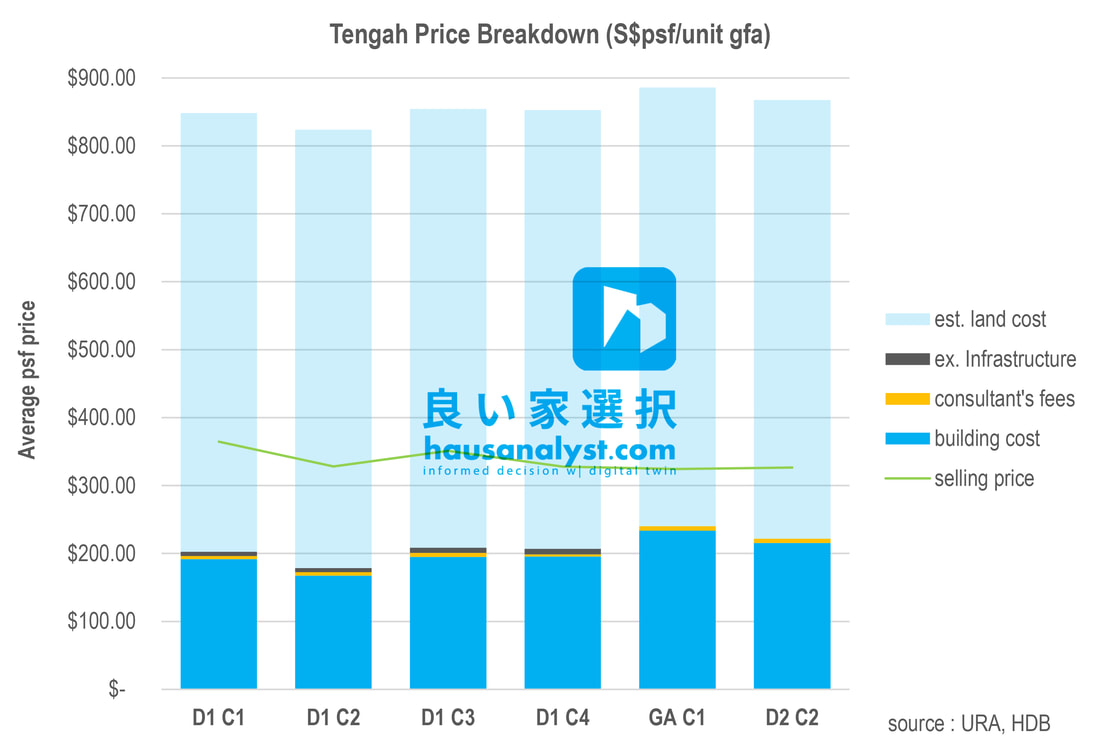

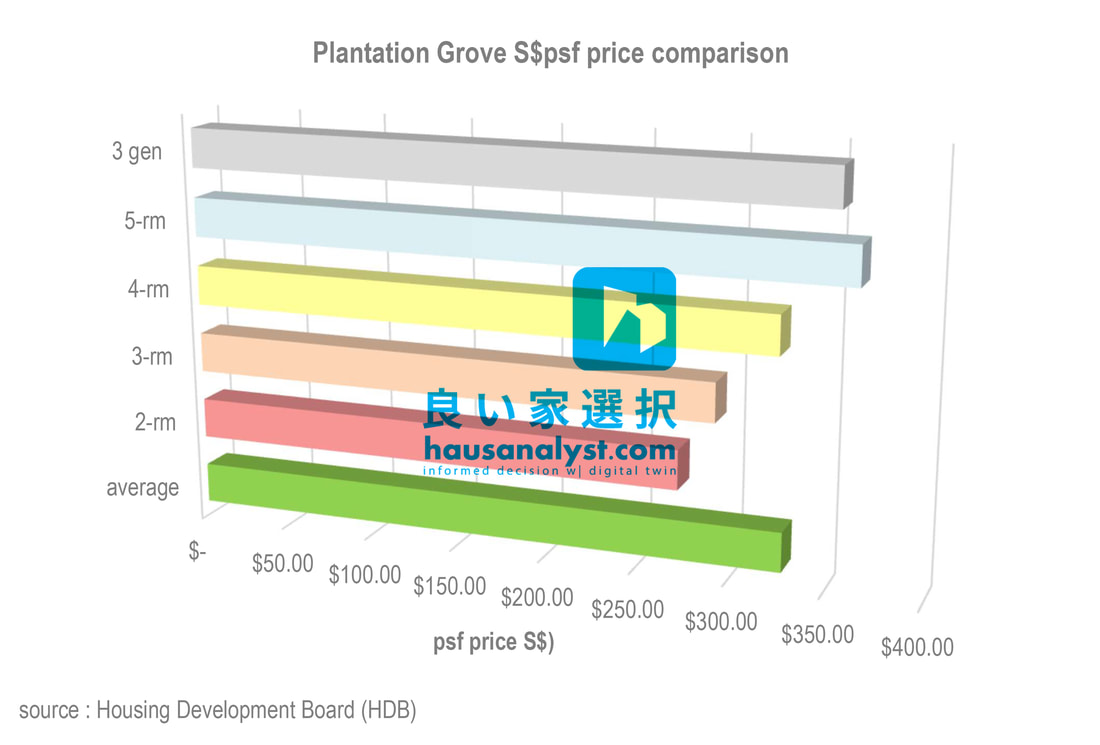

disclaimer: 1. Readers are advised to use information available here as study guide only and use it at your own risk. 2. Please note that changes/ update based on updated information will be made from time to time, readers are advised to check on this page regularly. 3. Analysis was done based on available data at the time of this review being published. Spanning across 700ha of land, Tengah is the latest test-bed for new township design evolution in Singapore. This new town was announced back in September 2016. It will have the first car-free town centre in Singapore and utilizing various smart technologies to create a sustainable and community-centric town. It will also house up to 42,000 new housing units, of which 30,000 public housing and 12,000 private housing (https://www.hdb.gov.sg/cs/infoweb/press-releases/corporate-pr-unveiling-the-masterplan-for-tengah-08092016). To date, a total of 7,260 public housing units has been launched over 6 developments. By the end of the year 2020, additional 2,610 public housing units will be added to the existing stocks and this will form close to 1/3 of the planned public housing units.

Please 'like' and 'share' this article if it helps you to better understand the public housing in Singapore. Next, we will analyse Bidadari (touted as the next gold mine), Tampines North (public housing within mature region) as well as Punggol NorthShore (sea front public housing). At www.hausanalyst.com, we strive to help future homeowners choose a better housing unit through scientific analysis with cutting edge 3D modelling and analysis to minimise future discomfort and downside risk which comes with lesser attributes. Sun exposure, wind exposure, distance, view angle and the sound disturbance will be our main focus as well as industry specific issues which homeowners won't know about. With millions of data points collected from our inch accurate models and pricing data, we are also a database outfit which strives to use data to better craft future housing base on Singapore housing experience. We welcome investors or partners who wish to work with us to chart new frontiers. Copyright © 2020 [email protected]

0 Comments

Leave a Reply. |

AuthorAn architect with 2 bachelor degrees. 15 years of industry related experience in Singapore, China and Malaysia. Designed for more than 10,000 units of completed residential property in Singapore, China and Malaysia including landed and non-landed alike. Designed for residential, healthcare, industrial and transportation oriented development (Finalist at World Architectural Festival 2014, Master planning; Won Singapore Institute of Planners Best Urban Design Project 2013). Completed projects including 1,010 units Punggol Topaz, Singapore, 2,290 units of landed and high-rise residential development in Xian, China, 4,236 units of high-rise residential development in Shenyang, China, 3,595 units of high-rise residential development in Chengdu, China and many more. Archives

September 2020

Categories |

RSS Feed

RSS Feed