|

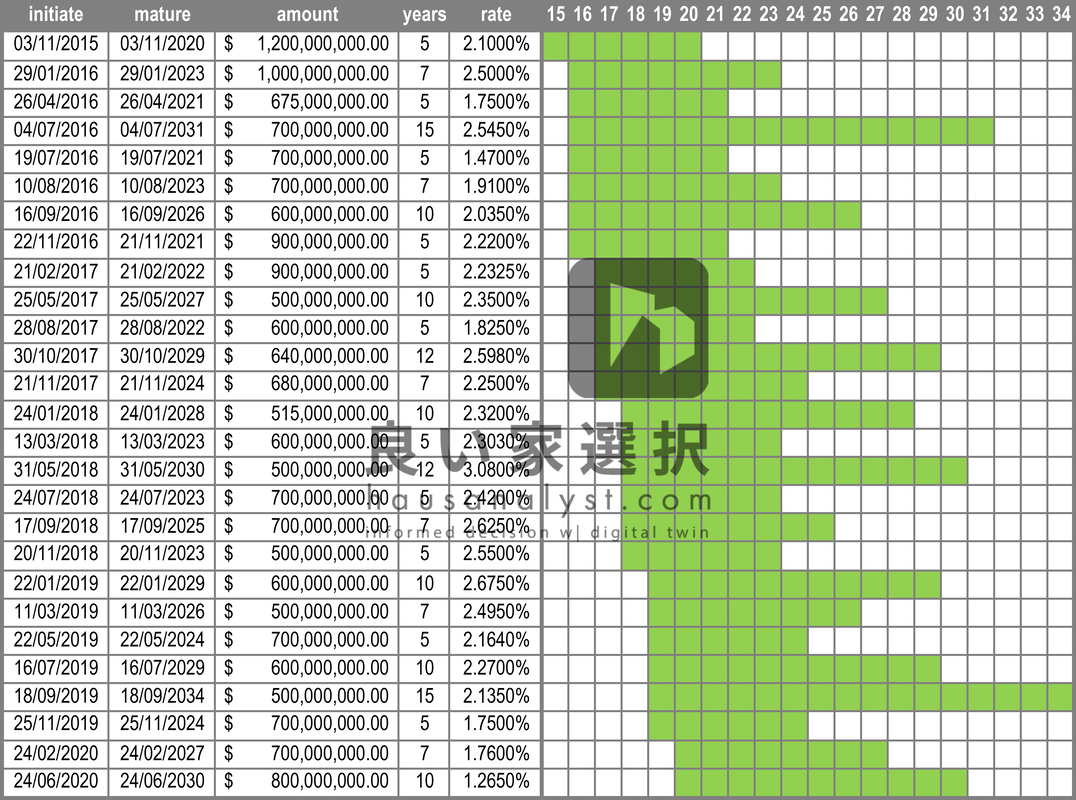

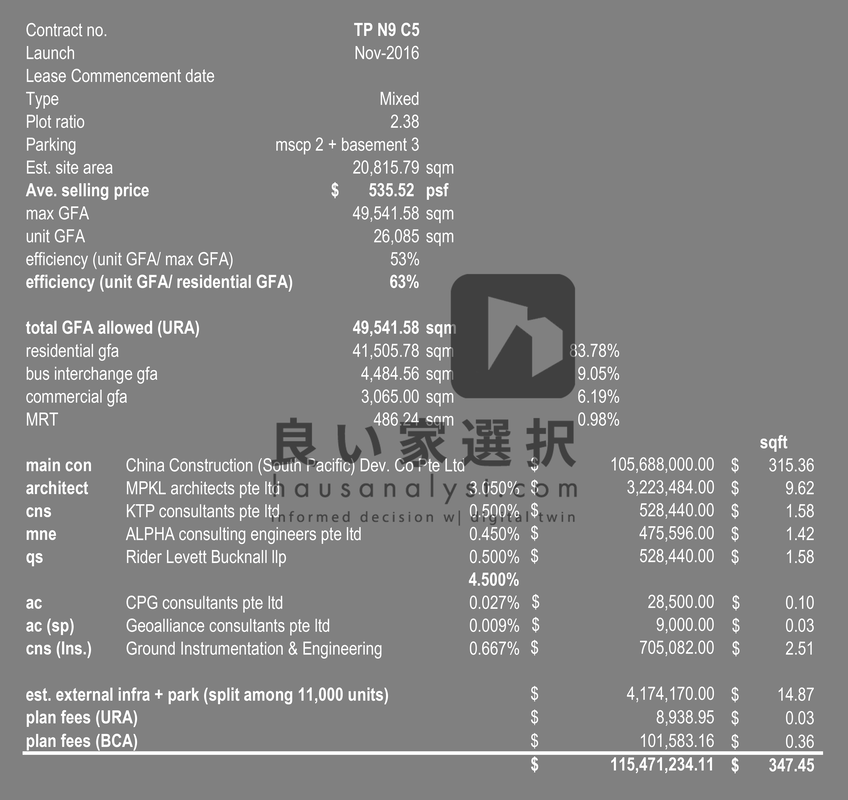

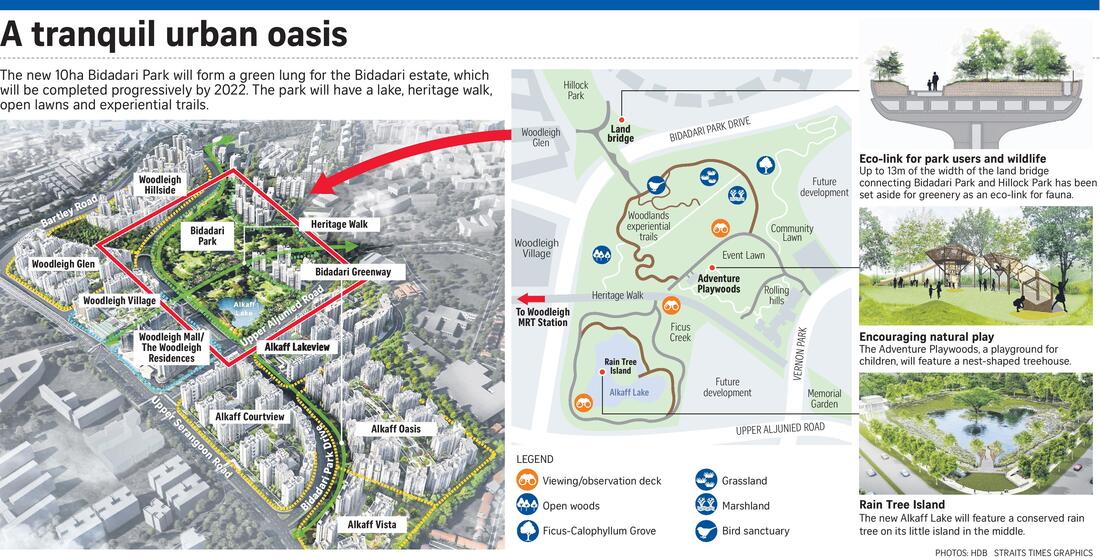

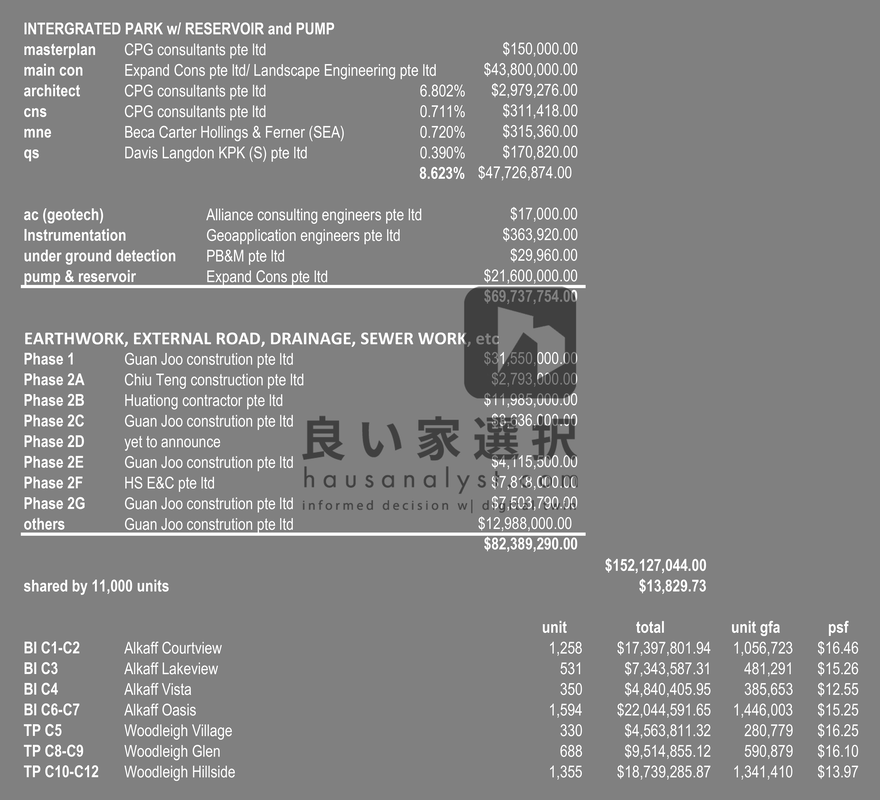

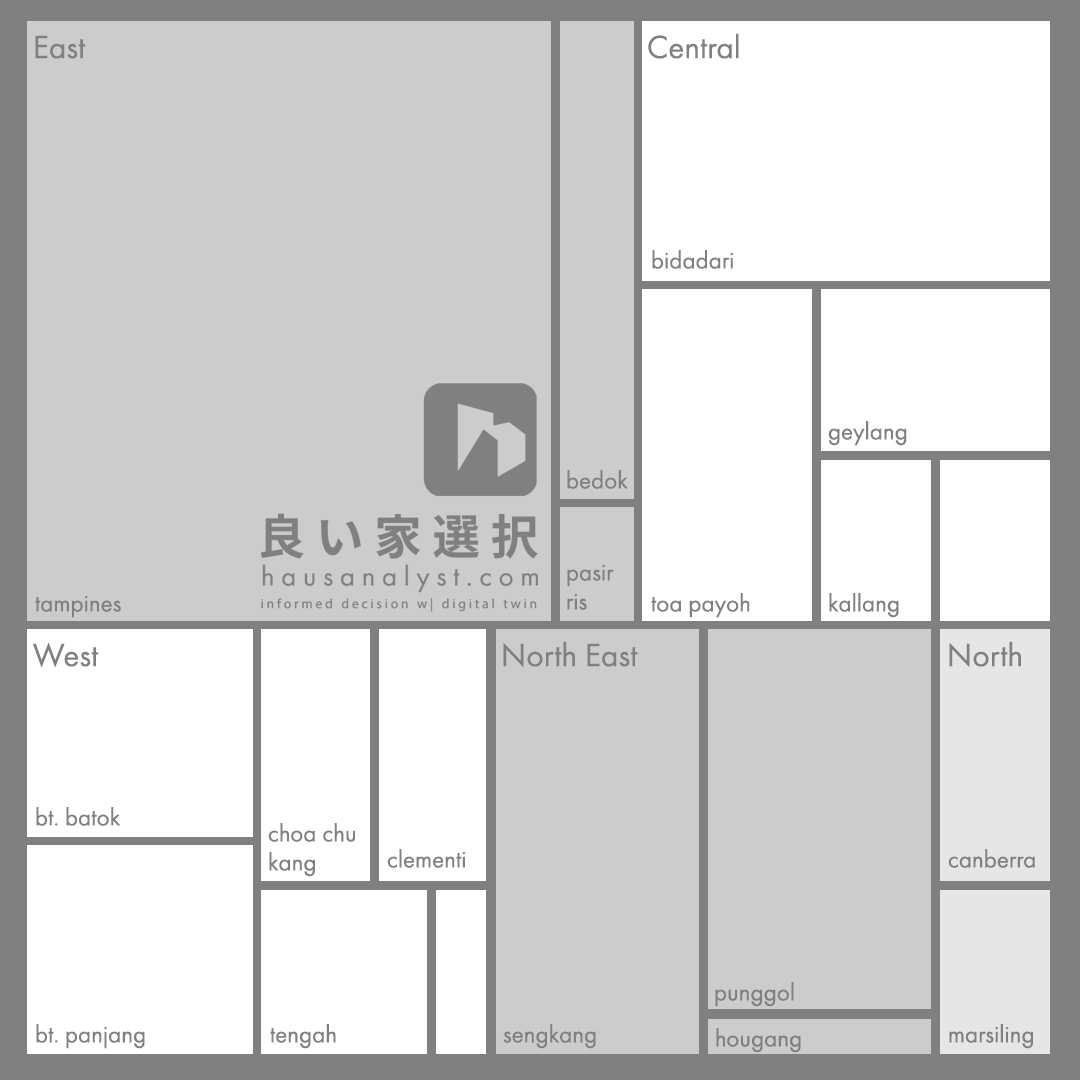

disclaimer: 1. Readers are advised to use information available here as study guide only and use it at your own risk. 2. Please note that changes/ update based on updated information will be made from time to time, readers are advised to check on this page regularly. 3. Analysis was done based on available data at the time of this review being published. "Every new town must be better than the previous one," said recently retired former Minister for Transport (previously helm the Ministry of National Development 2011-2015) Mr Khaw Boon Wan back in Aug 2013 when he launched the 3 new residential township which comprised Bidadari, Tampines North as well as Punggol Matilda. you saw it!“The 93-hectare Bidadari estate, with 11,000 housing units, will feature a lake inspired by the former Alkaff Lake Gardens. The Housing and Development Board (HDB) has envisioned the estate as a “tranquil urban oasis” for residents. There will be six neighbourhoods - Alkaff, Bartley Heights, Sennett, Park’s Edge and Woodleigh - with the first housing parcel in Alkaff Neighbourhood to be launched by 2015. The new Alkaff lake will be located in a new Bidadari Park, of around 10 hectares. The park will integrate an existing Memorial Garden commemorating the heritage of Bidadari Cemetery.” - Todayonline, 30, August 2013 To-date, 6,418 units (including 312 units of rented flats) of public housing have been launched in Bidadari. Another 1,230 units will be added to the existing stock by November 2020. That leaves another 2,350 units to be grabbed in the future. So, why was there a buzz when it was launched? Apart from being located in the central district, major part of this land mass (in some part still do) used to be land for the dead. You can read all about the history here. The thing about being a former cemetery could be the key to why homeowners are so anxious to get a piece of it. Bishan, another former cemetery land has created wealth for many property investors since (Chinese community believes in letting the dead have the best land for burial, therefore the price premium on it and later translated into property price increase). The notable difference is that the latter is a Chinese cemetery while the former (Bidadari) is a mixture of Christian, Muslim and others. you like it?In terms of selling price versus cost for construction, the same can be observed here whereby as a public housing development, land cost does not contribute to the selling price. Average selling price for the 7 developments launched thus far have seen an average of S$450-S$500 per square foot (psf). The majority of the cost for construction still came from the physical construction work itself, which equivalent to more than 90% of the total cost. The cost of land which we have shown in the chart (reference from the only private land sales activity) is mainly for reference to reflect that land cost is not included in the selling price.

you want a piece of it?

Please 'like' and 'share' this article if it helps you to better understand the public housing in Singapore. Next, we will analyse Tampines North (public housing within mature region).Copyright © 2020 [email protected]

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAn architect with 2 bachelor degrees. 15 years of industry related experience in Singapore, China and Malaysia. Designed for more than 10,000 units of completed residential property in Singapore, China and Malaysia including landed and non-landed alike. Designed for residential, healthcare, industrial and transportation oriented development (Finalist at World Architectural Festival 2014, Master planning; Won Singapore Institute of Planners Best Urban Design Project 2013). Completed projects including 1,010 units Punggol Topaz, Singapore, 2,290 units of landed and high-rise residential development in Xian, China, 4,236 units of high-rise residential development in Shenyang, China, 3,595 units of high-rise residential development in Chengdu, China and many more. Archives

September 2020

Categories |

RSS Feed

RSS Feed